NRBC Bank lottery draw on March 3

- আপডেট: ০৭:০৮:২৩ অপরাহ্ন, রবিবার, ২৮ ফেব্রুয়ারী ২০২১

- / ৪১৬২ বার দেখা হয়েছে

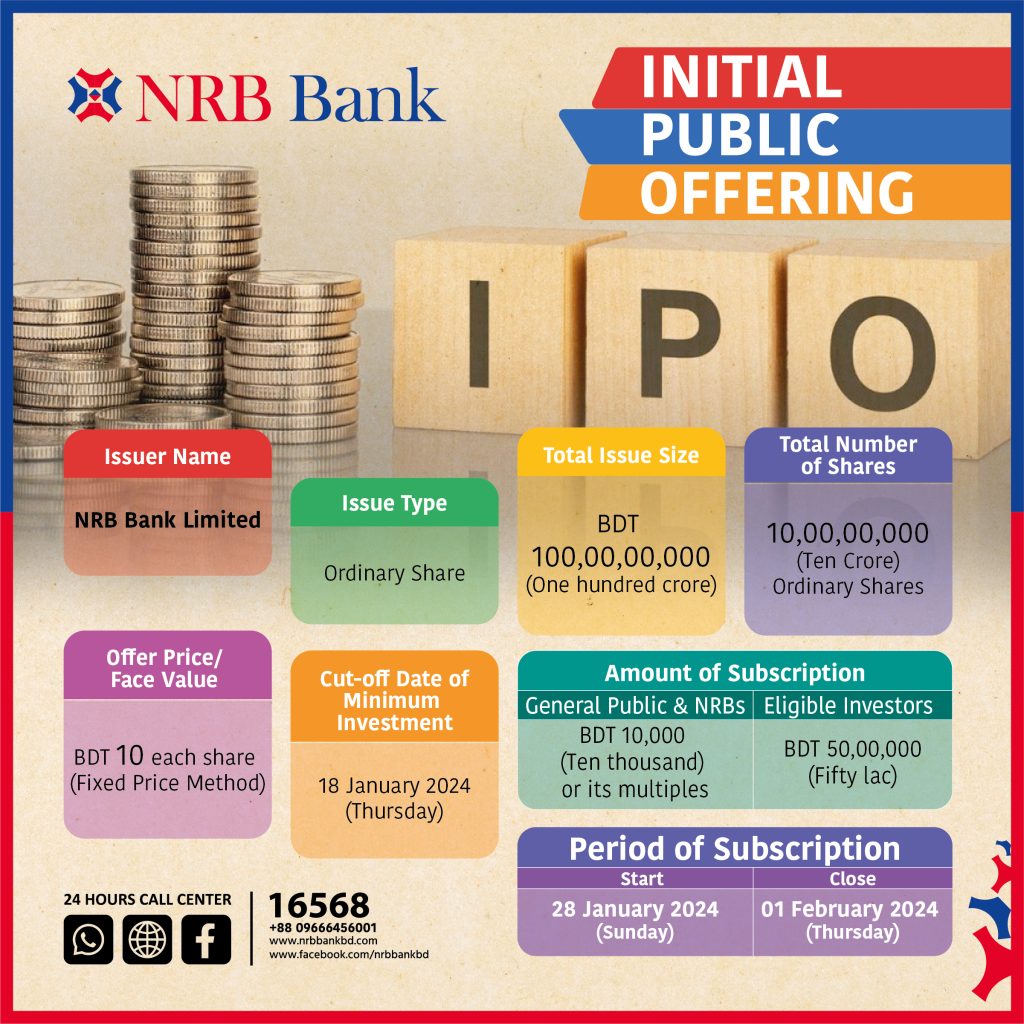

The lottery date for the initial public offering (IPO) of banking sector company NRB Commercial Bank Limited (NRBC) has been fixed. The company’s lottery draw will be held on Wednesday, March 3.

This information has been known from the company sources.

According to sources, NRBC Bank’s initial public offering (IPO) application has received a huge response. The company has received 7.75 times more applications than the demand. Investors have applied from February 3 to February 9.

NRBC Bank accepts IPO application for issuance of 12 crore ordinary shares on fixed price basis. The bank will collect 120 crore rupees. Each share has been priced at Rs. But 1 thousand 50 crore 15 lakh 36 thousand taka has been deposited in the IPO. Which is 7.75 times the demand.

In the company’s IPO, Bangladeshi general investors, damaged investors and expatriate Bangladeshis have deposited Tk 597.06 crore to get 60 per cent or Tk 72 crore shares allotted in the Bangladeshi category. And 40 percent of the eligible investors or 48 crore quota of 452 crore 36 lakh 35 thousand applications have been submitted.

The bank will raise Tk 120 crore from the capital market through the issuance of 12 crore ordinary shares. If NRBC Bank is listed, the number of listed banks in the country will stand at 31.

It may be mentioned that after 12 long years, the IPO of NRB Commercial Bank Limited in the banking sector was approved by the Bangladesh Securities and Exchange Commission (BSEC) on November 17.

The bank will raise Tk 120 crore through the issuance of 12 crore ordinary shares at a face value of Tk 10.

The money raised from the capital market will be spent on purchasing government securities, investing in the secondary market and IPO costs.

According to the audited financial statements of the company for the financial year ended June 30, 2020, the net asset value without revaluation has been 13 rupees 7 paise. The average earnings per share (EPS) for the last 5 years has been 1 taka 55 paise.

Asian Tiger Capital Partners Investment Limited and AFC Capital Limited are in charge of issue management of the company in the IPO.

Meanwhile, NRB Commercial (NRBC) Bank Limited has taken initiative to expand its services. In order to serve more people, the bank is giving priority to small and medium industries, cottages in remote areas, micro and small industries and agriculture.

On the other hand, the bank is moving from offline to online to enhance the quality of service and strengthen good governance. New technology based products and services are being launched based on the expertise of the bank’s own IT team.

Parvez Tamal, chairman of the bank, hopes that the good governance of the bank will increase further and many investors will benefit from it. The bank has also done well in the Corona crisis and will be able to pay a dividend of 12 to 14 per cent by the end of this year, he said.

Read more:

- Finding a 2,000-year-old chariot in Italy

- 12 crore in the block market

- Death in 24 hours in Corona: 375 identified

- Appointment of 6 independent directors of Familytex

- The companies that topped the transaction on Sunday

- The companies that topped the fall in prices on Sunday

- The companies that topped the price increase on Sunday

- Seats are increasing in medical admissions, 27 people will fight

- Myanmar protesters killed by police 5

- Share trading ended in the fall

- Celvo Chemical’s credit rating is complete

- BATBC is going to the spot market on Sunday

- First Finance has announced the date of AGM

- Transactions of four companies started on Monday