NRBC Bank’s IPO lottery results released

- আপডেট: ০৭:৫০:১২ অপরাহ্ন, বুধবার, ৩ মার্চ ২০২১

- / ৪২৫০ বার দেখা হয়েছে

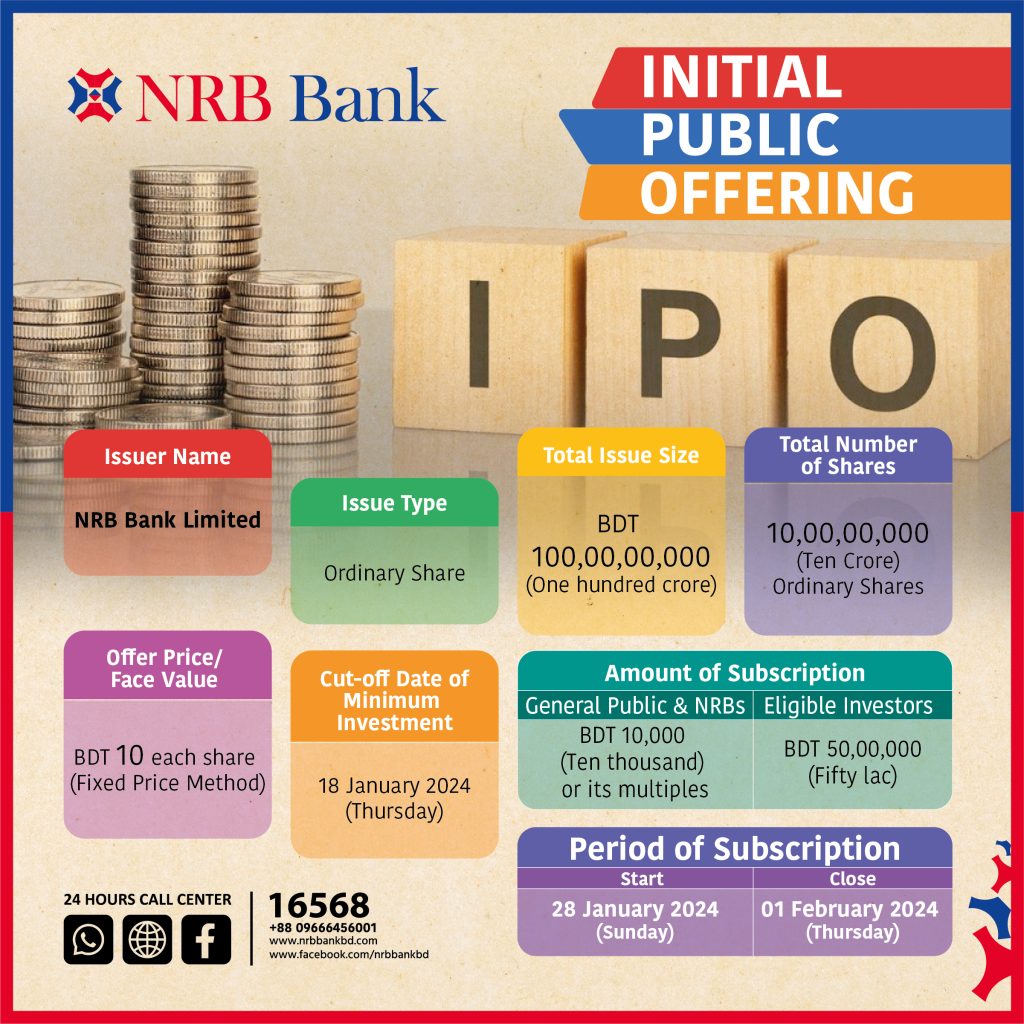

The results of the initial public offering (IPO) lottery of banking sector company NRB Commercial Bank Limited (NRBC) have been released. The lottery draw of Hotel Westin, Ballroom-3 (Level-1) Gulshan-2 Company was held at 11:30 am on Wednesday.

This information has been known from the company sources.

According to sources, NRBC Bank’s initial public offering (IPO) application has received a huge response. The company has received 8.729 times more applications than the demand. Investors have applied from February 3 to February 9.

NRBC Bank accepts IPO application for issuance of 12 crore ordinary shares on fixed price basis. The bank will collect 120 crore rupees. Each share has been priced at Rs. But 1 thousand 50 crore 15 lakh 36 thousand taka has been deposited in the IPO. Which is 7.829 times the demand.

In the company’s IPO, Bangladeshi general investors, damaged investors and expatriate Bangladeshis have deposited Tk 597.06 crore to get 60 per cent or Tk 72 crore shares allotted in the Bangladeshi category. And 40 percent of the eligible investors or 48 crore quota of 452 crore 36 lakh 35 thousand applications have been submitted.

The bank will raise Tk 120 crore from the capital market through the issuance of 12 crore ordinary shares. If NRBC Bank is listed, the number of listed banks in the country will stand at 31.

The money raised from the capital market will be spent on purchasing government securities, investing in the secondary market and IPO costs.

According to the audited financial statements of the company for the financial year ended June 30, 2020, the net asset value without revaluation has been 13 rupees 7 paise. The weighted average earnings per share (EPS) for the last 5 years has been 1 taka 55 paise.

Asian Tiger Capital Partners Investment Limited and AFC Capital Limited are in charge of issue management of the company in the IPO.

Download results:

| Serial No. | Subject | Download |

|---|---|---|

| 1 | Track number / Merchant Bank serial number | Download |

| 2 | General investor | Download |

| 3 | Lost investors | Download |

| 4 | Expatriate investors | Download |

Read more:

- 2280 Rohingyas on the way to Bhasanchar in the fifth phase

- Permission to import one lakh 60 thousand tons of rice again

- ADB is lending Tk 1,600 crore for power supply development

- The British American Tobacco transaction opened on Thursday

- Prime Insurance closed on Thursday

- Golden fiber board meeting today

- The seller has zero shares in four companies

- Beximco will issue Sukuk bonds worth Tk 3,000 crore

- If you have capital, who is responsible for safe investment?

- Action on receipt of defective audit report: NBR Chairman

- This time the board of directors of Emerald Oil has been reconstituted

- Lafarge Holcim has declared a dividend

- 12 IT companies are coming in the small cap of the capital market

- BTRC nominated for success in SIM database work

- Pakistan Premier League is more effective than IPL

- Former Barcelona president released on bail